Understanding Financial Accounting and Its Importance

Financial Accounting is an essential subject in the WAEC curriculum that prepares students for real-world financial management. This subject helps students understand how to track, summarize, and report the financial transactions of a business. Mastering Financial Accounting not only allows you to excel in your WAEC exams but also equips you with skills that are valuable in various professional fields.

Key Concepts in Financial Accounting

Before diving into the intricacies of balancing accounts, it is crucial to understand the fundamental concepts of Financial Accounting:

- Assets: Resources owned by a business that have economic value.

- Liabilities: Obligations or debts that a business owes to external parties.

- Equity: The owner's claim over the business assets after all liabilities have been deducted.

- Revenue: Income earned by a business from its operations.

- Expenses: Costs incurred by a business in the process of earning revenue.

Steps to Balance Accounts

Balancing accounts involves ensuring that the total debits equal the total credits in a ledger. Here are the essential steps to achieve this:

- Recording Transactions: First, all financial transactions must be accurately recorded. This process involves journal entries where each transaction is listed as a debit (Dr) or credit (Cr).

- Posting to Ledger Accounts: Transfer the journal entries to their respective ledger accounts. Each account will have a dedicated ledger, such as "Cash," "Accounts Receivable," "Sales," etc.

- Calculating Balances: For each ledger account, calculate the total debits and credits. Determine the balance by subtracting the lesser total from the greater total.

- Trial Balance: Prepare a trial balance by listing all ledger accounts along with their balances. The total debits should equal the total credits. This helps identify any discrepancies.

- Adjusting Entries: Make necessary adjustments for any unrecorded transactions or errors. Adjusting entries ensure that the financial statements are accurate.

- Closing Entries: Finally, prepare closing entries to transfer the balances of revenue and expense accounts to the "Income Summary" account, and then to the "Retained Earnings" account.

Common Errors to Avoid

When learning how to balance accounts, it is easy to make mistakes. Here are some common errors to avoid:

- Forgetting to record transactions or recording them in the wrong period.

- Incorrectly classifying transactions, such as recording an expense as an asset.

- Omitting ledger entries or duplicating them.

- Mathematical errors when calculating account balances.

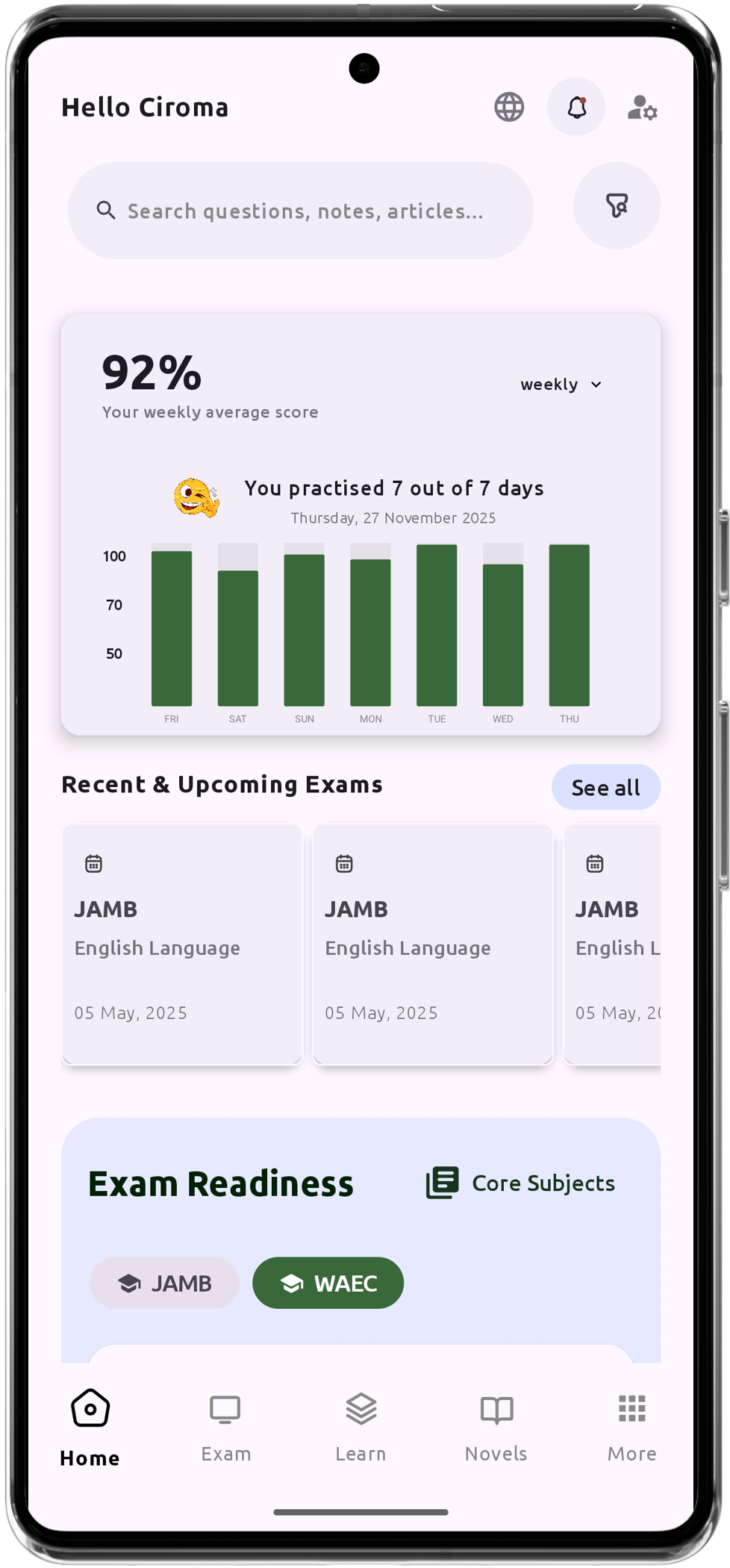

Practice makes perfect; therefore, using lesson notes and practising with WAEC past questions will help you master these concepts. For thorough learning and better preparation, check out the Green Bridge CBT mobile app for comprehensive lesson notes, videos, and podcasts.

Practical Example

Let's consider a practical example:

Suppose a business makes a cash sale of ₦10,000. Here’s how the transaction is recorded and balanced:

- Journal Entry:

- Dr Cash ₦10,000

- Cr Sales ₦10,000

- Posting to Ledger:

- Cash Ledger: Dr ₦10,000

- Sales Ledger: Cr ₦10,000

- Calculating Balances:

- Cash Ledger: Total Dr ₦10,000, Balance = ₦10,000

- Sales Ledger: Total Cr ₦10,000, Balance = ₦10,000

- Trial Balance:

- Debits: Cash ₦10,000

- Credits: Sales ₦10,000

Result: Total Debits ₦10,000 = Total Credits ₦10,000

Through these steps, you ensure that your accounts are balanced, which is critical for accurate financial reporting.

Kommentar(e)