Welcome to your comprehensive guide on Financial Accounting for WAEC. Mastering financial accounting can be one of the pivotal elements in excelling in your WAEC exams. This lesson note is designed to highlight key accounting principles to boost your understanding and performance.

Understanding Basic Accounting Principles

Accounting principles are the backbone of financial accounting. These principles provide a framework that ensures consistency and reliability in the financial information generated. Here are some basic accounting principles you need to know:

- Entity Principle: This principle states that the business is separate from its owner and other businesses. It ensures that the financial records are specific to the business entity alone and not mixed with personal transactions.

- Money Measurement Principle: According to this principle, only items that can be measured in monetary terms are recorded in the financial statements. This excludes non-quantifiable items like employee skills or reputation.

- Cost Principle: Also known as the historical cost principle, it states that assets should be recorded at their cost at the time of acquisition, not at their current market value.

- Dual Aspect Principle: This is the foundation of double-entry bookkeeping. Every transaction affects at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

Key Financial Statements

Understanding financial statements is crucial for those studying Financial Accounting. The three primary financial statements are:

- Income Statement: This shows the company's revenue and expenses during a specific period. The purpose is to calculate the net profit or loss for that duration. Key components include gross profit, operating expenses, and net profit.

- Balance Sheet: Also known as the statement of financial position, it provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. The balance sheet formula is Assets = Liabilities + Owner’s Equity.

- Cash Flow Statement: This statement shows the inflows and outflows of cash within a business over a specific period. It helps in understanding the liquidity and overall financial health of the business.

Double-Entry Bookkeeping

Double-entry bookkeeping is an essential concept for anyone preparing for WAEC Financial Accounting. The system relies on the principle that every financial transaction has equal and opposite effects in at least two different accounts. If you debit one account, you must credit another. Here’s a simple example:

- Purchasing equipment for cash: Debit Equipment account, Credit Cash account.

- Sales made on credit: Debit Accounts Receivable, Credit Sales Revenue.

- Payment of salaries: Debit Salary Expense, Credit Cash.

This system helps maintain the accuracy and integrity of financial records, making it an invaluable practice for attending secondary school exams such as WAEC and NECO.

Trial Balance and Error Rectification

A trial balance is a list of all ledger accounts and their balances at a particular date. The primary purpose of the trial balance is to test the arithmetical accuracy of the ledger accounts. If the total debits equal total credits, the ledger accounts are considered balanced. Common types of errors include:

- Errors of Omission: Transactions not recorded.

- Errors of Commission: Transactions recorded in the wrong account.

- Errors of Principle: Transactions not recorded according to generally accepted principles.

- Compensating Errors: Errors that cancel each other out.

Correcting these errors promptly ensures the reliability of financial statements, a key focus area for the WAEC Financial Accounting syllabus.

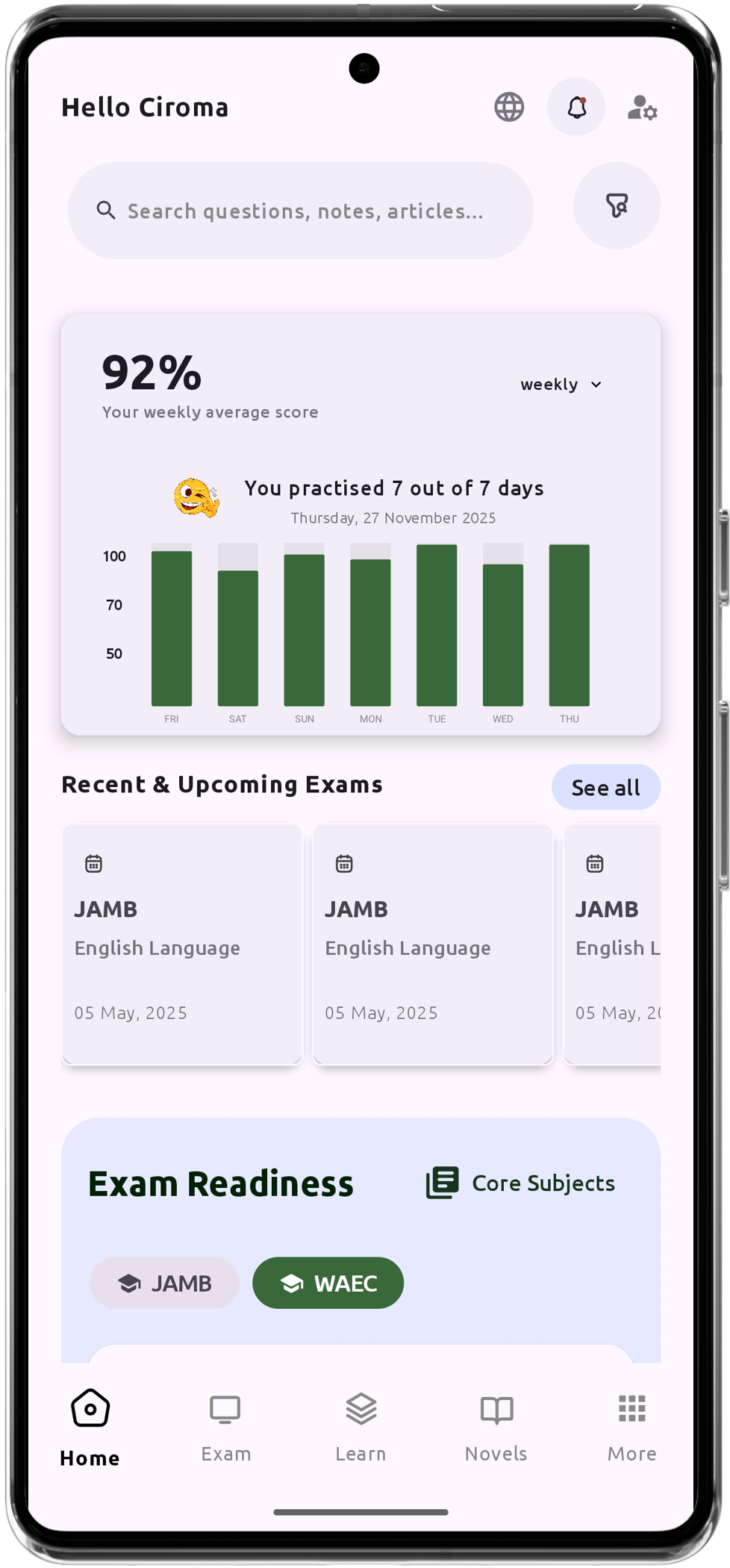

For more detailed notes, practice questions, and other learning resources, you can access our extensive collection at Green Bridge CBT. Don't forget to download our Android mobile app here for seamless access on the go.

Comentário(s)