Preparing for the WAEC Financial Accounting exam involves rigorous understanding and practice of various key accounting topics. By practicing with past questions, students can gain valuable insight into the types of questions they might encounter and the critical areas they need to focus on. Below are some key accounting topics that frequently appear in WAEC Financial Accounting past questions.

Principles of Double-Entry Accounting

The double-entry accounting system is the foundation of accurate financial record-keeping. It requires that every financial transaction affects at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. WAEC past questions often require students to demonstrate proficiency in recording transactions using double-entry principles. Students should master how to record various types of transactions, such as sales, purchases, expenses, and revenues, using both the debit and credit parts of the accounts involved.

Final Accounts

Understanding how to prepare final accounts is crucial for any accounting student. The preparation of these accounts involves compiling a company's financial statements at the end of an accounting period. This includes:

- Trading Account: Focuses on determining the gross profit or loss by showing the relationship between sales and the cost of goods sold.

- Profit and Loss Account: Used to ascertain the net profit or net loss by taking into consideration all other incomes and expenses.

- Balance Sheet: A statement that shows the financial position of a business by summarizing its assets, liabilities, and equity at a specific point in time.

WAEC past questions often ask students to prepare these final accounts based on given trial balances or adjusted trial balances. Proficiency in creating accurate final accounts is fundamental for scoring high marks.

Bank Reconciliation Statements

Bank reconciliation is an important process that compares and reconciles the bank balance as per the cash book with the balance as per the bank statement. WAEC Financial Accounting exams frequently feature problems relating to the preparation of bank reconciliation statements. Students must be adept at identifying discrepancies such as unpresented cheques, bank charges, and errors in the cash book. Accurate reconciliation ensures that all transactions are correctly recorded and helps in maintaining the integrity of financial records.

Depreciation of Fixed Assets

The concept of depreciation is essential in accounting, as it helps in allocating the cost of fixed assets over their useful lives. WAEC past questions often test students on various methods of calculating depreciation, such as:

- Straight-Line Method: Depreciation expense is constant every year.

- Reducing Balance Method: Depreciation expense decreases annually as it is calculated on the reduced book value of the asset.

- Units of Production Method: Depreciation based on the asset's usage or productivity.

Understanding and being able to apply these methods correctly is vital for answering WAEC Financial Accounting exam questions effectively.

Trial Balance

The trial balance is a summary of all ledger balances prepared at the end of an accounting period to check the accuracy of bookkeeping. WAEC past questions typically include preparation of trial balances, identifying and correcting errors that might cause discrepancies. Students need to be familiar with various types of errors, such as errors of omission, commission, and principle, as these often appear in exam questions.

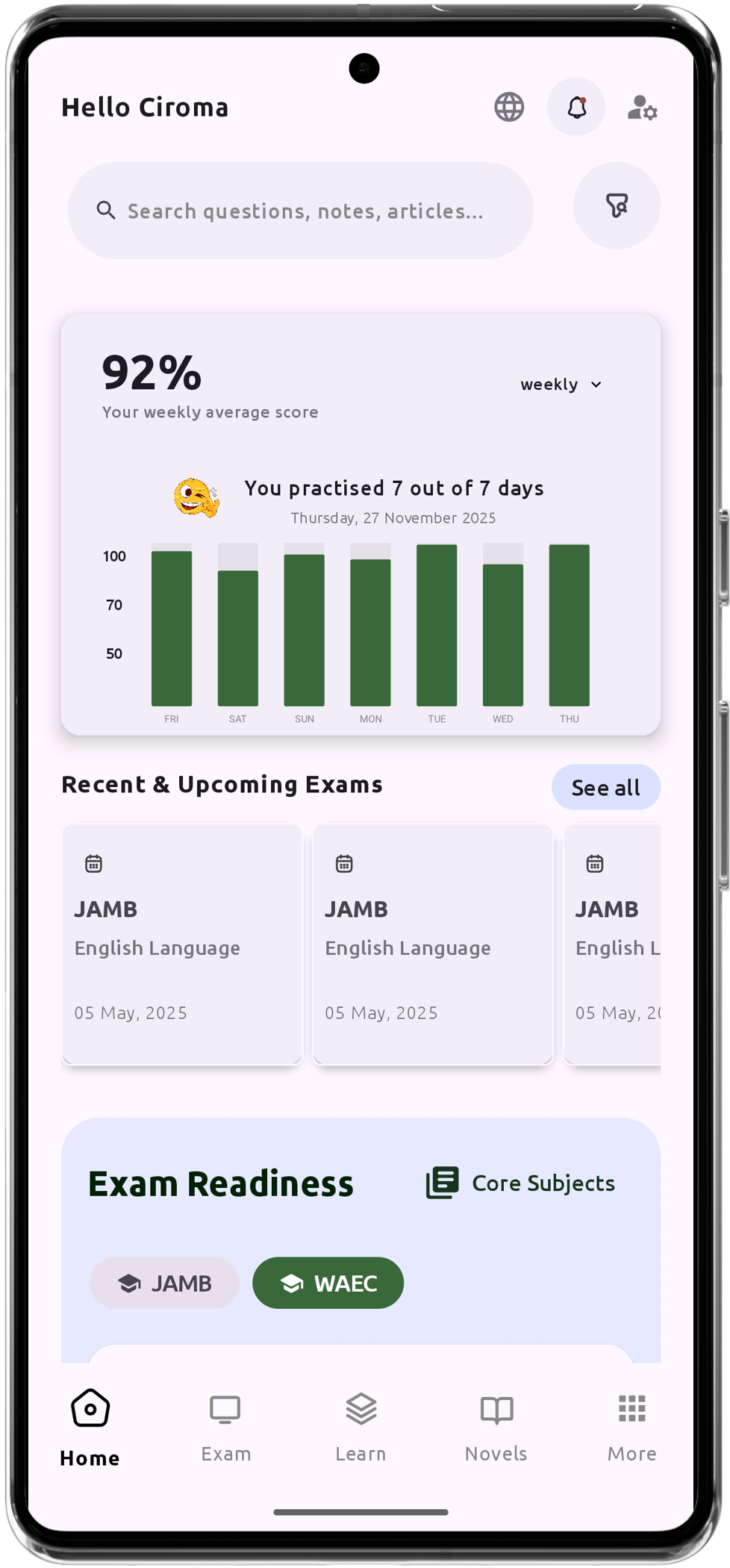

Practicing with WAEC Financial Accounting past questions will significantly enhance your understanding and application of these key accounting concepts. For comprehensive preparation, consider utilizing extensive resources such as lesson notes, videos, and practice tests available on platforms like Green Bridge CBT. Access these materials through our website or via our Android mobile app to boost your preparedness for the WAEC Financial Accounting exam.

Comment(s)