Understanding Commerce for JAMB and WAEC Exams

Commerce is one of the essential subjects for students preparing for JAMB UTME, WAEC SSCE, or NECO SSCE. It explores various aspects of trade, business, and economics that are critical in the modern world. Preparing adequately with comprehensive lesson notes and practice materials can make a significant difference in your performance. Here, we break down core Commerce topics that you need to master for these exams.

Nature and Scope of Commerce

Commerce involves the activities of buying and selling goods and services. It covers various processes and support services that facilitate trade, including transportation, banking, insurance, advertising, and warehousing. Understanding how these components interrelate helps you grasp the broader context of commercial activities.

Trade and Types of Trade

Trade is the activity of buying, selling, or exchanging goods and services between people or entities. There are various types of trade you need to know:

- Home Trade: This includes domestic trade within a country's borders. It comprises wholesale and retail trade. As you study, pay attention to how goods move through different stages—from manufacturers to wholesalers, retailers, and finally to consumers.

- Foreign Trade: Also known as international trade, it involves the exchange of goods and services between countries. Foreign trade can further be classified into import, export, and entrepot trade.

Business Units

Understanding different forms of business organizations is crucial. These include:

- Sole Proprietorship: A business owned and managed by a single individual who bears all risks and enjoys all profits.

- Partnership: A business owned by two or more people who share responsibilities, risks, and profits.

- Corporation: A legal entity separate from its owners, owned by shareholders who share profits but have limited liability.

- Cooperative Society: An organization owned and operated by a group of individuals for their mutual benefit.

Financial Institutions

Financial institutions play a vital role in commerce by providing mechanisms for saving, borrowing, and investing money. Key types include:

- Commercial Banks: These banks offer a wide range of services including accepting deposits, providing loans, and offering basic investment products.

- Central Bank: The apex financial institution responsible for regulating the money supply and implementing monetary policies.

- Insurance Companies: These provide risk management in the form of insurance contracts, compensating for financial losses.

Channels of Distribution

Understanding the channels of distribution helps you know how products move from producers to final consumers. These channels include:

- Direct Channel: The producer sells directly to the consumer.

- Indirect Channel: Involves intermediaries such as wholesalers, agents, and retailers who facilitate the movement of goods.

Marketing and Advertising

Marketing involves identifying consumer needs and ensuring that products meet these needs better than competitors. Advertising is a component of marketing aimed at informing and persuading potential customers. Effective advertising can significantly impact sales and brand loyalty.

Study Tools and Resources

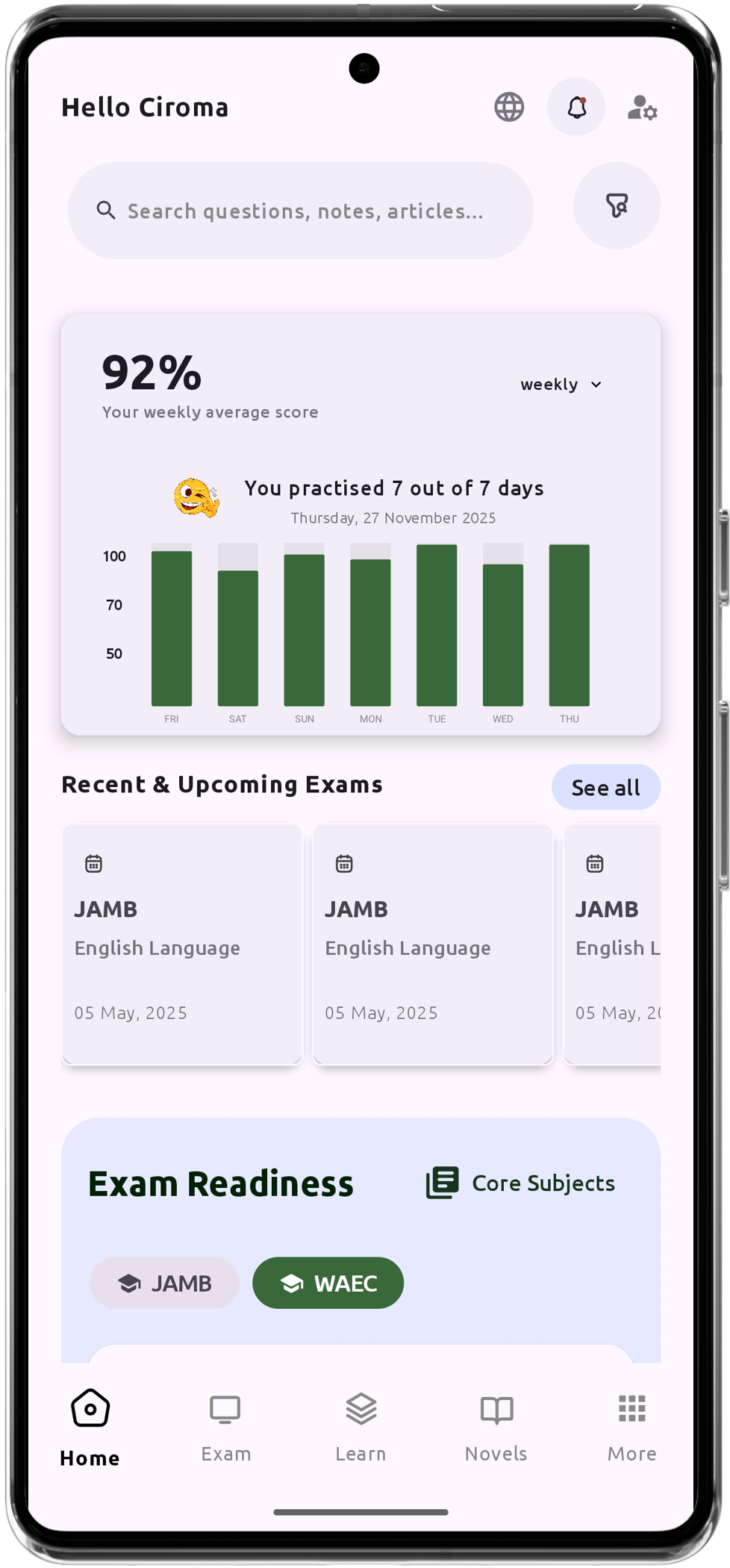

Access to quality study materials is essential for mastering these topics. You can find comprehensive lesson notes and other learning resources on our platform. In addition, using tools like past questions can aid your preparation. For a more interactive learning experience, consider using our Android mobile app.

By understanding these core topics and utilizing available study resources, you’ll be well on your way to excelling in your Commerce exams for JAMB and WAEC.

Comment(s)